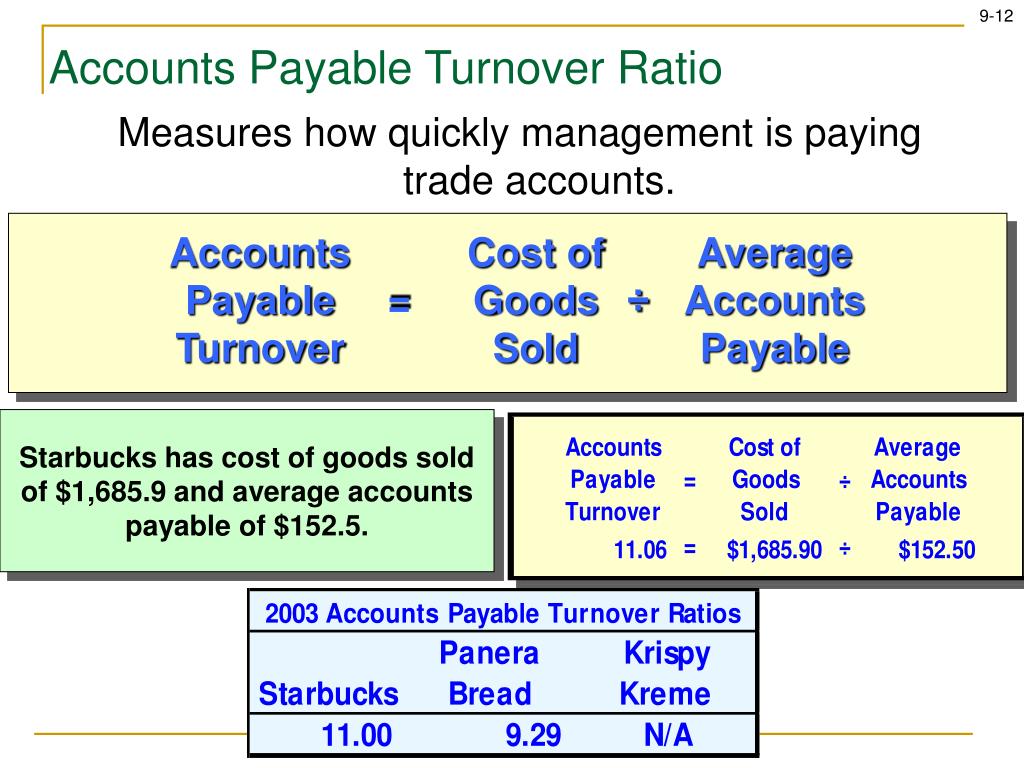

Since an increased level of accounts payable causes the accounts payable turnover ratio to decrease, a decrease in the A/P turnover ratio means the company is paying its payables more slowly, which is an indication of possible liquidity problems. The accounts payable turnover ratio measures the time period over which a company is allowed to hold trade payables before being obligated to pay suppliers. So the average accounts payable will increase. But a high accounts payable turnover ratio is not always in the best interest of a company. Conversely, a lower accounts payable turnover ratio usually signifies that a company is slow in paying its suppliers. The higher the number, the more often the payables are cleared (paid). The numerical value is customarily reported as an annual value. Paying payables more slowly causes the balance in the accounts payable account to increase because it is not being reduced as quickly by making payments on the payables. A high ratio means there is a relatively short time between purchase of goods and services and payment for them. The accounts payable turnover rate is a business activity ratio measuring the frequency of the companys ability to pay its vendors and suppliers. So the next invoice from that same supplier might not be paid until 90 days have elapsed. To know whether this is a high or low ratio, compare it to other companies within the same industry. This means that Company A paid its suppliers roughly five times in the fiscal year. But then, the company starts having cash flow problems, so it starts paying its suppliers more slowly. Accounts payable turnover ratio 10 million / ( (1.6 million + 2.2 million) / 2) So, the accounts payable turnover ratio would be: 5.26. For example, an invoice from a supplier might be paid in 30 days one month. The accounts payable turnover ratio decreases when a company starts paying its suppliers more slowly. Posted in: Accounting ratios (calculators) By: Rashid Javed Updated on: October 28th, 2017 Net credit purchases: Average accounts payable: Calculate Reset. When the Annual Credit Purchases remains the same but the Average Accounts Payable balance increases, the A/P turnover ratio will decrease because the denominator of the calculation has increased. Accounts payable turnover ratio calculator. The A/P turnover ratio is Annual Credit Purchases / Average Accounts Payable. Receivable Turnover Ratio or Debtors Turnover Ratio is an accounting measure used to measure how effective a company is in extending credit as well as.

0 kommentar(er)

0 kommentar(er)